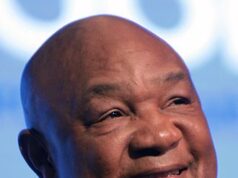

Kenneth C. Griffin, born in 1968, is an American hedge fund manager, entrepreneur, and investor, best known as the founder, CEO, and co-chief investment officer of Citadel LLC, a multinational hedge fund. He also founded Citadel Securities, one of the largest market makers in the U.S., which is responsible for approximately 35% of all U.S.-listed retail volume. As of April 2023, Griffin had an estimated net worth of $35 billion, making him one of the wealthiest individuals in the world. In addition to his professional successes, Griffin is known for his philanthropy, having donated over $1.56 billion to various charitable causes, particularly in education, economic mobility, and medical research.

Here are 26 Facts about the the hedge fund manager

1. Kenneth C. Griffin was born on October 15, 1968, in Daytona Beach, Florida. He is the son of a building supplies executive, and his grandmother, Genevieve Huebsch Gratz, inherited an oil business, three farms, and a seed business.

2. Griffin grew up in Boca Raton, Florida, with some time in Texas and Wisconsin. He went to middle school in Boca Raton and Boca Raton Community High School, where he was the president of the math club.

3. In high school, Griffin ran a discount mail-order education software firm, EDCOM, out of his bedroom. In a 1986 article in the Sun-Sentinel, he said he thought he would become a businessman or lawyer and that he believed the job market for computer programmers would significantly decrease over the coming decade.

Ken Griffin at 17: “”I wanted to know how people who made video games made them.”

by u/FartinLutherKing in Superstonk

4. Griffin started his college education at Harvard College in the fall of 1986. That year, one of his first investments was to buy put options on Home Shopping Network, making a $5,000 profit.

5. At Harvard, despite a ban on running businesses from campus, Griffin convinced school administrators to allow him to install a satellite dish on the roof of his dormitory to receive stock quotes. He also asked Terrence J. O’Connor, the manager of convertible bonds at Merrill Lynch in Boston, to open a brokerage account for him with $100,000 that Griffin had gotten from his grandmother, his dentist, and others.

6. His first fund launched in 1987 with $265,000, days after his 19th birthday. The fund launched in time to profit from short positions on Black Monday (1987).

7. Griffin graduated from Harvard in 1989 with a degree in economics. After graduating, Griffin moved to Chicago to work with Frank Meyer, founder of Glenwood Capital Investments.

8. Frank Meyer allotted $1 million of Glenwood capital for Griffin to trade, and Griffin made 70% in a year. In 1990, Griffin founded Citadel LLC, with assets under management of $4.6 million, aided by contributions from Meyer.

9. His funds made 43% in 1991 and 40% in 1992. In the early 2000s, Griffin founded market maker Citadel Securities.

10. In 2003, aged 34, Griffin was the youngest person on the Forbes 400, with an estimated net worth of $650 million. As of April 2023, Griffin had an estimated net worth of $35 billion.

11. He was ranked 21st on the 2022 Forbes 400 list of richest Americans. Griffin was included in Forbes’s 2023 list of America’s Most Generous Givers.

12. He has donated $1.56 billion to various charitable causes, primarily in education, economic mobility, and medical research. Griffin has also contributed tens of millions of dollars to political candidates and causes, usually Republican or conservative in ideology.

13. Citadel Securities, founded by Griffin, is a leading global market maker for a wide array of fixed income and equity products. It is the U.S.’s biggest equity and options market maker.

14. Its automated equities platform trades more than 20% of U.S. equities volume across more than 11,000 U.S.-listed securities. It also trades over 16,000 OTC securities and executes approximately 35% of all U.S.-listed retail volume.

15. Citadel Securities is a separate entity from the hedge fund Citadel LLC, although both were founded by Ken Griffin. In September 2015, Citadel Securities launched a European fixed-income market-making business, marking its first step to build a broader European trading

16. Citadel Securities has faced legal actions from regulators. In January 2017, it agreed to pay $22.6 million to U.S. market regulators to settle charges that it misled customers over the prices they were getting for some of their deals.

17. In December 2018, Citadel Securities agreed to pay penalties of $3.5 million to the SEC for submitting incomplete and inaccurate blue sheet data. The SEC uses such data to investigate potential insider trading and other fraud.

18. Citadel Securities has made strategic investments to grow its business. In May 2019, it invested $5 million into The Small Exchange, a start-up retail focused futures exchange.

19. In October 2020, Citadel Securities planned to acquire IMC’s market making unit on the New York Stock Exchange (NYSE) trading floor. This acquisition would expand Citadel’s position as one of the largest floor brokers on the NYSE floor in terms of market cap and number of securities.

20. Citadel Securities acts as a specialist or market maker in more than 4,000 U.S. listed-options names, representing 99% of traded volume. It also ranks as a top liquidity provider on the major U.S. options exchanges.

21. Citadel Securities is the largest Designated Market Maker (DMM) on the floor of the New York Stock Exchange. It is also one of the world’s largest Exchange-Traded Fund (ETF) traders.

22. Valuation Metrics, a Citadel Securities Corporate Solutions offering, provides clients with focused targeting of institutional investors. This service is part of Citadel Securities’ diverse array of financial products and services.

23. Kenneth Griffin has been active in the financial industry since 1990. He is known as the Founder of Citadel LLC and Citadel Securities.

24. Griffin holds the titles of CEO and co-CIO of Citadel LLC. He is recognized as one of the most influential figures in the hedge fund industry.

25. Griffin has been married twice. His first marriage was to Katherine Weingartt, which ended in divorce in 1996, and his second marriage was to Anne Dias, which ended in divorce in 2015. He has three children.

26. Griffin’s hedge fund has been linked to naked short selling of Gamestop and other notable companies. Another related practice is cellar boxing where positions remain on the books of hedge funds as unrealized gains, which provides financial flexibility as well as tax deferrance.